Everyone feeling good about the outlook of the American economy leading up to this presidential election? …Yeah, us too. The debates have at the very least been entertaining, but have done little to ease the minds of Americans worried about the economy and the job market moving forward.

Regardless of the candidate that takes office, it will take a while for any economic impacts to be realized. So if you’re like us at RMH Systems, we are trying to understand what the manufacturing landscape will look like for the next year or so. We’ve entered into the 4th quarter, and we are all trying to estimate year-end financials, whether we’ve hit our goals, and what we can budget for in 2017. According to our research, the state of manufacturing in the U.S. isn’t quite as “doom and gloom” as the squabbling candidates lead us to believe.

In a recent webinar by Industry Week, Stephen Gold, CEO of the Manufacturing Alliance for Production and Innovation (MAPI), said “Manufacturing is the single most critical component of our economy.” He justified his position with the upstream supply and downstream sales in the manufacturing cycle. Of course everyone reading this article would probably agree with Gold’s comments regardless, but the following fact surely supports his claim.

$1 spent in manufacturing sector = $3.66 in downstream economic activity

That’s a pretty startling number. The entire manufacturing value stream, according to MAPI, accounts for one-third of the Gross Domestic Product (GDP). For each of us, the success of the industry hits home, but understanding the impact the manufacturing sector has on the rest of the economy makes the future of the sector all that more important.

The industry growth in 2016 has been disappointingly slow, and experts don’t expect that to change moving forward. They’re not predicting a decline at this point, but forecasting continued slow growth. MAPI has conservatively projected 1.6% growth in US manufacturing in 2017. The folks at Trading Economics predict a flat 2017. That’s certainly not uplifting, but the manufacturing sector has a few things moving in its favor: its downstream economic impact, and emphasis on innovation. The innovation factor is the most interesting. We see companies moving more and more into automation. Automated processes and industrial robotics are becoming more prevalent in warehouses, and are here to stay. For the manufacturing sector to grow, companies must be willing to invest in technology and automation to stay competitive.

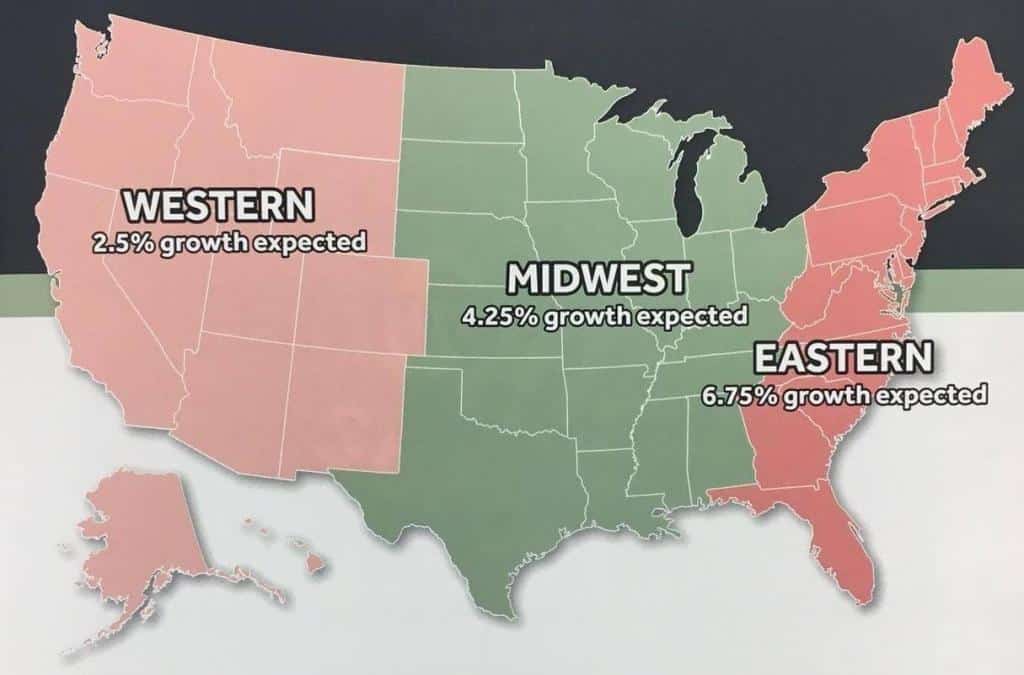

So the experts predict slow growth? What do they know? They’re just “experts”…The Material Handling Equipment Distributors Association (MHEDA) recently released their 4th quarter projections, which are based off of survey results from hundreds of industry CEOs across the country. Obviously, material handling suppliers and distributors don’t make up the entirety of the industry, but they certainly provide a good pulse for what’s going on. Their projections are a little more positive:

So we’ve got the experts predicting flat growth and the industry guys projecting 2.5 – 6.5% growth. The reality will likely be somewhere in the middle, which is still encouraging. The industries that the MHEDA group predicts will see the most growth are: automation, construction, warehousing, and food and beverage. As a MHEDA member, we have historically found their survey results to be pretty close to end results.

To realize any growth there are a number of challenges that organizations have to face. The list below is by no means a complete list. The big 5 below seem to be the most prevalent across the expert and industry panels.

- Global markets- the global economies are sluggish. This creates a strong dollar, and causes international customers to balk at US prices. We also see international players entering the US with a cheaper product due to lower manufacturing costs. It’s a big cycle that makes our products more expensive.

- Commodities: the energy sector is down…way down. The prices for oil and gas have slowed production tremendously.

- Corporate tax rates: the taxation corporations face today make it very difficult to invest in capital growth.

- Labor force: the labor force of today is aging. Finding, recruiting, and retaining skilled workers is a challenge for just about everyone these days. This seems to be an issue that will continue for the foreseeable future, making the investment in automation all that more important.

- IoT: the technology sector is moving faster than anyone could predict. Included in that growth is the phenomena of the Internet of Things (IoT). This buzzword is in ever industry magazine you pick up. Undoubtedly, it’s something we have to understand and implement in our warehouses.

Enough to think about? Well at least nobody has families, fantasy football rosters, or a presidential circus to think about…Nonetheless, the challenge is upon us. The upcoming year has potential for real growth. The onus, ultimately, falls on us to be committed to innovation, creative with our labor force, and focused on our expenses. Let’s get to work, the American economy depends on us.